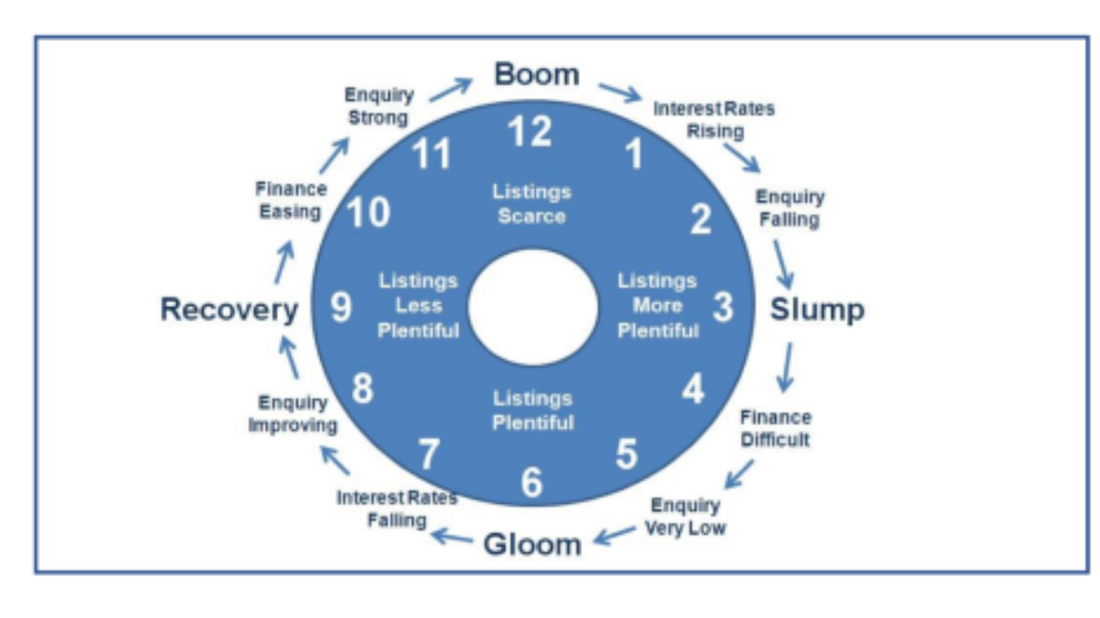

This is an excellent graphic showing the age old cycle of real estate prosperity (or otherwise). The fun bit is picking where on the hands of a clock viewers think we are at here in Dunedin. Most commentators have Auckland at around 6 pm and of course the press lumps in the rest of the country as following this even if there is the usual lag. The old story-when Auckland slows the rest of the country follows in 6 months. Auckland slowed because of an over heated market with prices unrealistically high forcing buyers to look and buy in the regions and further cooled by the OIA restrictions on foreign buying that came on in late 2018.

Well this following of the “big smoke” trend simply has not happened in the case of Dunedin residential, as Auckland has been between 3 and 6pm for well over a year and Dunedin has been between 9 and 12 for that duration. Why? Simply supply and demand. When I started real estate 11 years ago (right after the GFC!) there were typically 900-1000 residential properties for sale to account for around 200 plus sales a month - days to sell were around 40 and the median sale price $230-$250k. Right now in Dunedin available stock is under 200 to sustain more sales per month. Everything is selling - even problematic properties and the median has risen to around $430k with days to sell around 25. To compound the low stock availability buyer interest has never been higher as the good press about Dunedin reaches far and wide, the hospital rebuild looms closer and interest rates continue at all time lows. It is acknowledged that the DCC was unprepared for the rapidity of growth in the city’s population and rezoning and the release of land for residential sections has been agonisingly slow compromised by the restrictiveness of inadequate services to sustain growth in key areas such as the Taieri. Parallelling the residential buoyancy of course is the pressure on rental accommodation with rents rising driven by demand particularly for the mainstream rental market.

So what is my take on the future - I think our clock will be stuck for a bit around midday (boom) for some time as supply of property is no quick fix and the impact of the hospital rebuild—influx of families, prosperity – will not be a short term thing. Our median price for property is still materially less than the other major cities. Dunedin remains a highly desirable place to live. Without a major international negative turn of events and with continuing low interest rates we will buck the trend and we are not following Auckland because of the economic dynamics we have here. A cautionary note: HOWEVER in time we will start another revolution of the clock and head toward the low that eventually no local/regional/national economy escapes.

For more insights, Miles can be contacted on 027 201 0567.